- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 27-08-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Construction Work Done | Quarter II | -1.9% | -1% |

| 06:00 | Germany | Gfk Consumer Confidence Survey | September | 9.7 | 9.6 |

| 08:00 | Eurozone | Private Loans, Y/Y | July | 3.3% | |

| 08:00 | Eurozone | M3 money supply, adjusted y/y | July | 4.5% | 4.7% |

| 08:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | August | -24.0 | |

| 14:30 | U.S. | Crude Oil Inventories | August | -2.732 | -2.133 |

| 16:20 | U.S. | Fed Barkin Speech | |||

| 21:30 | U.S. | FOMC Member Daly Speaks |

Major US stock indices declined moderately as investors weighed in on recent events surrounding the trade war between Washington and Beijing.

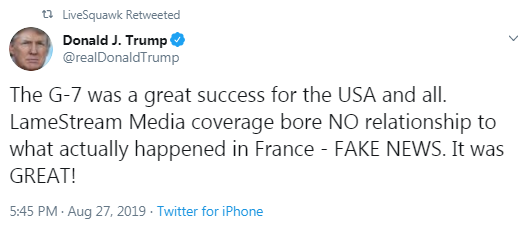

Comments by officials of the two largest economies in the world on Monday signaled a potential rapprochement after escalating trade tensions over the weekend. Following the G7 summit in the French city of Biarritz on Monday, US President Donald Trump predicted a deal with China, citing economic pressure on Beijing, while China called for a resolution of the current dispute.

However, Trump’s statements on the G7 that the Chinese representatives called the U.S. Department of Commerce and asked to return to the dialogue were questioned by the Global Times chief editor, who told Twitter that, as he knew, the negotiators on both sides did not communicate by telephone. The Chinese Foreign Ministry has also confirmed that it has not received a single trade call from the United States recently.

Market participants also evaluated macroeconomic reports. A S & P / Case-Shiller report showed that the home price index, which tracks home prices in 20 US metropolitan areas, rose 2.1% in June year-on-year after rising 2.4% in May. It was the smallest annual increase in housing prices since August 2012. Economists forecast a 2.4% price increase.

The Conference Board reported that the consumer confidence index fell slightly in August after it recorded a strong increase in July. The index now stands at 135.1 (1985 = 100), compared with 135.8 in July. Analysts had expected the index to fall to 129.5. The current situation index, based on consumers' assessment of the current business and labor market conditions, increased from 170.9 to 177.2, while the expectations index, based on short-term consumer forecasts regarding income, business and labor market conditions, decreased from 112.4 to 107.0.

Most of the DOW components completed trading in the red (19 of 30). The biggest gainers were Johnson & Johnson (JNJ, + 1.75%). Outsider were shares of UnitedHealth Group Incorporated (UNH, -3.64%).

All S&P sectors recorded a decline. The conglomerate sector showed the largest drop (-1.1%).

At the time of closing:

Dow 25,777.90 -120.93 -0.47%

S&P 500 2,869.16 -9.22 -0.32%

Nasdaq 100 7,826.95 -26.79 -0.34%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Construction Work Done | Quarter II | -1.9% | -1% |

| 06:00 | Germany | Gfk Consumer Confidence Survey | September | 9.7 | 9.6 |

| 08:00 | Eurozone | Private Loans, Y/Y | July | 3.3% | |

| 08:00 | Eurozone | M3 money supply, adjusted y/y | July | 4.5% | 4.7% |

| 08:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | August | -24.0 | |

| 14:30 | U.S. | Crude Oil Inventories | August | -2.732 | -2.133 |

| 16:20 | U.S. | Fed Barkin Speech | |||

| 21:30 | U.S. | FOMC Member Daly Speaks |

The Conference

Board announced on Tuesday its U.S. consumer confidence gauge fell 0.7 point to

135.1 in August from 135.8 in July.

Economists had

expected consumer confidence to come in at 129.5.

July’s consumer

confidence reading was revised slightly up from originally estimated 135.7.

The survey

showed that the expectations dropped from 112.4 last month to 107.0 this month,

while the present situation index increased from 170.9 to 177.2.

Lynn Franco,

Senior Director of Economic Indicators at The Conference Board, noted, “Consumer

confidence was relatively unchanged in August, following July’s increase. Consumers’

assessment of current conditions improved further, and the Present Situation

Index is now at its highest level in nearly 19 years (Nov. 2000, 179.7).

Expectations cooled moderately, but overall remain strong. While other parts of

the economy may show some weakening, consumers have remained confident and

willing to spend. However, if the recent escalation in trade and tariff

tensions persists, it could potentially dampen consumers’ optimism regarding

the short-term economic outlook.”

S&P

reported on Tuesday its Case-Shiller Home Price Index, which tracks home prices

in 20 U.S. metropolitan areas, rose 2.1 percent y-o-y in June, following an

unrevised 2.4 percent y-o-y increase in May. That was the smallest annual

advance in house prices since August 2012.

Economists had

expected an advance of 2.4 percent y-o-y.

Phoenix (+5.8 percent y-o-y), Las Vegas (+5.5

percent y-o-y) and Tampa (+4.7 percent y-o-y) recorded the highest y-o-y gains

in June.

Meanwhile, the

S&P/Case-Shiller U.S. National Home Price Index, which measures all nine U.S.

census divisions, was up 3.1 percent y-o-y in June, down from 3.3 percent y-o-y

in the previous month.

Home price

gains continue to trend down, but may be leveling off to a sustainable level,” noted

Philip Murphy, Managing Director and Global Head of Index Governance at S&P

Dow Jones Indices. “The average YOY gain declined to 3.0% in June, down from

3.1% the prior month. However, fewer cities (12) experienced lower YOY price

gains than in May (13). The southwest (Phoenix and Las Vegas) remains the

regional leader in home price gains, followed by the southeast (Tampa and

Charlotte). With three of the bottom five cities (Seattle, San Francisco, and San

Diego), much of the west coast is challenged to sustain YOY gains. For the

second month in a row, however, only Seattle experienced outright decline with

YOY price change of -1.3%. The U.S. National Home Price NSA Index YOY price

change in June 2019 of 3.1% is exactly half of what it was in June 2018. While

housing has clearly cooled off from 2018, home price gains in most cities

remain positive in low single digits. Therefore, it is likely that current

rates of change will generally be sustained barring an economic downturn.”

Aline Schuiling, the senior economist at ABN AMRO, says that the call for fiscal stimulus in the Eurozone is becoming louder, but the room for stimulus is limited by EU rules and national political choices.

- “We have calculated the potential room for stimulus from different perspectives. First, there is room within the European Commission’s MTOs (Medium-Term Objectives). If the countries that have either met or passed their obligations from the MTO used the available fiscal room, around EUR 65bn of stimulus would be feasible. The bulk by Germany (EUR 54bn) and the Netherlands (EUR 9bn). Alternatively, the rules of the EC could be ignored, and we can calculate the level of stimulus that would result in stabilisation of the debt ratio at its current level. This would result in a total potential stimulus of around EUR 160bn. Again, the bulk by Germany (EUR 85bn) and the Netherlands (EUR 25bn).

- Finally, the EC already allows countries to deviate temporarily from their MTOs in order to accommodate investment when their economies are contracting or growing well below their potential, albeit under a strict set of conditions. Although it is difficult to translate this guidance into exact numbers, we think that extra government investment of around EUR 140bn would be possible in total.

- Assuming that a fiscal stimulus equal to 1% of GDP, lifts eurozone GDP by around 0.5-0.7%, we calculate that our range of estimates of the room for fiscal stimulus (EUR 65bn – EUR 160bn) would lift eurozone GDP growth by between around 0.25 and 0.75 pps.

- Depending on the shape and size of the stimulus, it could start having an upward impact on growth in the course of 2020. Our current base case scenario is that eurozone growth will remain stuck at modest levels well below the trend rate throughout 2020.

- A fiscal stimulus package in line with maximum potential size according to our calculations (around EUR 160bn) could lift growth to close to the trend rate in the course of 2020. Still, governments are not moving quickly or significantly, so we think any stimulus would be at the low end of the range.”

U.S. stock-index futures rose moderately on Tuesday as investors continued to monitor developments in U.S.-China trade relations.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,456.08 | +195.04 | +0.96% |

Hang Seng | 25,664.07 | -16.26 | -0.06% |

Shanghai | 2,902.19 | +38.63 | +1.35% |

S&P/ASX | 6,471.20 | +31.10 | +0.48% |

FTSE | 7,096.86 | +1.88 | +0.03% |

CAC | 5,379.67 | +28.65 | +0.54% |

DAX | 11,747.15 | +89.11 | +0.76% |

Crude oil | $54.22 | +1.08% | |

Gold | $1,539.30 | +0.14% |

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 17.25 | 0.08(0.47%) | 3796 |

ALTRIA GROUP INC. | MO | 47.79 | 0.67(1.42%) | 37218 |

Amazon.com Inc., NASDAQ | AMZN | 1,773.00 | 4.13(0.23%) | 20216 |

Apple Inc. | AAPL | 207.72 | 1.23(0.60%) | 133716 |

AT&T Inc | T | 34.98 | 0.05(0.14%) | 9773 |

Boeing Co | BA | 360.5 | 1.46(0.41%) | 16071 |

Caterpillar Inc | CAT | 114.98 | 0.56(0.49%) | 2581 |

Cisco Systems Inc | CSCO | 47.48 | 0.38(0.81%) | 9285 |

Citigroup Inc., NYSE | C | 62.7 | -0.02(-0.03%) | 3387 |

E. I. du Pont de Nemours and Co | DD | 64.3 | 0.04(0.06%) | 114 |

Exxon Mobil Corp | XOM | 68.15 | 0.30(0.44%) | 5225 |

Facebook, Inc. | FB | 181.45 | 1.09(0.60%) | 25598 |

FedEx Corporation, NYSE | FDX | 153.05 | 0.56(0.37%) | 1603 |

Ford Motor Co. | F | 8.88 | 0.06(0.68%) | 25728 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 8.92 | 0.08(0.91%) | 11312 |

General Electric Co | GE | 8.03 | -0.02(-0.25%) | 50850 |

General Motors Company, NYSE | GM | 36.35 | 0.10(0.28%) | 4103 |

Goldman Sachs | GS | 200.01 | 0.36(0.18%) | 1021 |

Google Inc. | GOOG | 1,172.00 | 3.11(0.27%) | 3089 |

Home Depot Inc | HD | 219.5 | 0.85(0.39%) | 1510 |

Intel Corp | INTC | 45.9 | 0.34(0.75%) | 14581 |

International Business Machines Co... | IBM | 130.68 | 0.69(0.53%) | 3205 |

Johnson & Johnson | JNJ | 129.1 | 1.30(1.02%) | 50527 |

JPMorgan Chase and Co | JPM | 106.7 | -0.17(-0.16%) | 8571 |

McDonald's Corp | MCD | 217.7 | 0.79(0.36%) | 2305 |

Microsoft Corp | MSFT | 136 | 0.55(0.41%) | 94597 |

Nike | NKE | 82.58 | 0.33(0.40%) | 1059 |

Pfizer Inc | PFE | 35 | 0.16(0.46%) | 7965 |

Procter & Gamble Co | PG | 119.93 | 0.61(0.51%) | 1303 |

Starbucks Corporation, NASDAQ | SBUX | 96.38 | -0.12(-0.12%) | 1600 |

Tesla Motors, Inc., NASDAQ | TSLA | 215.4 | 0.40(0.19%) | 28087 |

The Coca-Cola Co | KO | 54.76 | 0.22(0.40%) | 2726 |

Twitter, Inc., NYSE | TWTR | 41.51 | 0.07(0.17%) | 31010 |

UnitedHealth Group Inc | UNH | 233.99 | 2.91(1.26%) | 1516 |

Verizon Communications Inc | VZ | 57.39 | 0.68(1.20%) | 39395 |

Visa | V | 178 | 0.41(0.23%) | 7628 |

Wal-Mart Stores Inc | WMT | 112.3 | 0.31(0.28%) | 2229 |

Walt Disney Co | DIS | 136.09 | 1.48(1.10%) | 22721 |

Yandex N.V., NASDAQ | YNDX | 36.21 | 0.06(0.17%) | 100 |

- Says monetary policy is data dependent, not market dependent

- It is important to get the market view about where the economy stands

- Also important to get the view of where it is heading

- Expectations that are priced in financial markets need to be taken with a pinch of salt

Analysts at Deutsche Bank note that today's 2nd release confirmed the preliminary reading of the German Q2 GDP growth of -0.1% qoq and corrected for the lower number of working days it was up 0.4% while domestic demand rose a healthy 0.5% qoq.

- “Net trade subtracted a 0.5 pp from Q2 GDP growth with exports falling a hefty 1.3% qoq while imports decreased by 0.3% qoq.

- Capex investment picked up by 0.6% qoq (Q1: 1.4%) while construction investments were down 1.0% qoq (Q1: 2.5%), partly a payback for the weather-related surge in Q1.

- In H1 the German government sector recorded a surplus of EUR 45.3 bn (or 2.7% of GDP). That said, it is important to note that these figures are preliminary and have only limited informative value for the overall 2019 budget results.

- Yesterday's sharper than expected drop in the ifo climate index was part of a row of negative sentiment and hard data, particularly for manufacturing. This supports our expectation that GDP will shrink by around ¼% qoq in Q3, pushing the German economy into a "technical recession".”

Julien Manceaux, the senior economist at ING, note that Franch consumer confidence stabilized in August at 102 after a strong recovery in the last three months.

- "Fears of unemployment, in particular, have fallen thanks to the good private job creation figures over the first six months and the decline in unemployment to 8.5%. The figures from the INSEE survey published this morning, however, still show high saving intentions, which have not weakened since February.

- The rise in consumer confidence has not yet pushed up consumer spending, which was still down for goods in June (and saw no growth in the second quarter). However, we continue to expect a rebound in the second half of the year. Indeed, even if the fall in unemployment comes to an end in early 2020, it will continue in the coming months, supporting confidence and tempering saving plans. The tax boost announced by the government should also have an effect in the second half of the year as we don't think all the money will be saved. The figures this morning could be reflected in the consumer spending data for July later this week, alongside the revision to second quarter GDP.

- The business climate also remained broadly stable in August. This survey continued to show weakening prospects for employment growth, confirming that improvements in the job market should come to an end, but only by early next year.

- As a result, private consumption (which grew by only 0.2% quarter-on-quarter in the second quarter after 0.4% in the first) should pick up in the second half of the year. However, the base effect is significant and it is unlikely that this improvement will bring consumption growth above 1.2% in 2019, after only 0.9% in 2018. Only when households feel that their savings are replenished will the measures taken have a greater effect on accelerating private consumption. That's why we expect 1.4% growth in 2020."

Analysts at TD Securities note the market expects the Richmond Fed Manufacturing Index of U.S. to register its first improvement in six months with a 10pt gain to -2 in August.

- “The index was as high as 14 back in February but has since declined to -12, in line with the ongoing woes in the manufacturing sector.

- Separately, the Conference Board's consumer confidence index is expected to have given back some of its July gain, dropping to a still-strong 129 level in August from 135.7 before.”

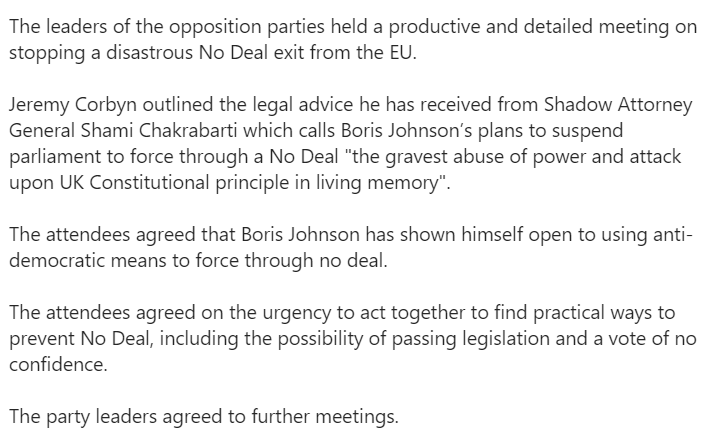

- PM Johnson thinks there is enough time to agree on backstop alternative

- PM Johnson to speak with Juncker later today

Carsten Brzeski, the chief economist at ING Germany, notes that just released second estimate of German 2Q GDP data shows that not all was bad.

- "The economy still contracted by 0.1% quarter-on-quarter, which is 0.4% year-on-year. The details of the growth components show that the contraction was almost exclusively driven by weak exports. Domestically, only the construction sector disappointed, which was more the result of an unusually strong first quarter than a more general downswing in what is probably Germany’s last booming sector right now.

- While at second glance the 2Q GDP data has some bright spots, the short-term outlook for the German economy remains bleak. As mentioned in yesterday’s analysis of the Ifo index the German economy is at a dangerous crossroads. On the back of weak confidence indicators, the risk of another contraction of the economy in the third quarter and hence a technical recession has recently increased, not decreased. The resilience of the domestic economy against the industrial slowdown and external woes has only started to weaken since the summer. And while there could be a rebound in the construction sector in 3Q, high inventories in 2Q and little sign of exports rebounding significantly make another stagnating quarter very likely.

- Still, don’t forget that no single hard data point for the third quarter has been released, yet. Also, after ten years of strong economic growth, a stagnation or even a technical recession at this juncture is not yet a reason to panic. All will depend on the way forward. Some relief from trade could easily lead to a rebound towards the end of the year. Fiscal stimulus could boost confidence and improve structural growth in the years ahead. However, a further escalation of the trade conflict and global uncertainty combined with no fiscal stimulus at all, is currently probably the worst of all nightmares for the German economy."

According to Danske Bank analysts, an eventful G7 meeting concluded yesterday as on Iran, French President Emmanuel Macron said that an US-Iran deal could be reached if Iranian President Hassan Rouhani and Trump meet.

“Trump agreed 'if the circumstances were correct'. An agreement still seems far away, though. On global trade, the G7 leaders agreed that there is a need for modernising and reforming the WTO system to make it more efficient, reflecting the changing economic structures. While it seems doubtful the US and China are anywhere close to a trade deal despite Trump's comments yesterday, it was positive that Trump said that the US and the EU are 'very close to doing a deal'. We have to be careful about Trump's comments but this topic will be increasingly on our radar ahead of Trump's decision in November whether to impose tariffs on auto imports from Europe or not.”

Austria has the room to heed the ECB’s call for some governments to provide fiscal stimulus as economic growth slows, the country’s outgoing central bank Governor Ewald Nowotny said.

“We have a balanced budget, or even a small surplus,” Nowotny said. “That’s a positive development, but it can’t be a goal in itself. If it’s economically necessary, this leeway should be used.”

Nowotny, whose term expires Aug. 31, won’t be at the table when the ECB’s Governing Council discusses potential monetary stimulus at next month’s meeting. But the word of the professor and former Social Democratic lawmaker still matters in domestic politics as the Alpine nation heads toward a snap national election on Sept. 29.

Japanese Economy Minister Toshimitsu Motegi said on Tuesday he did not think U.S.-Japan trade talks would result in an outcome that would cause concern for Japanese automakers.

Motegi made the remarks to reporters in Tokyo after the United States and Japan agreed in principle to core elements of a trade deal on Sunday at a Group of Seven leaders summit in Biarritz, France.

Under that deal, Tokyo made concessions on agriculture while Washington refrained from raising its current auto tariffs on Japanese car imports while negotiations continued.

In light of the recent price action, a probable test of the 0.63 area in NZD/USD appears to have lost momentum for the time being, according to FX Strategists at UOB Group.

24-hour view: “No change in view from yesterday, see reproduced update below. That said, after yesterday’s strong rebound, the prospect for a move to 0.6300 has diminished further”.

Next 1-3 weeks: “NZD rebounded to 0.6411 last Friday (12 Aug) before ending on a firm note at 0.6395 (+0.51%). However, events over the weekend sent it plunging to a low of 0.6342 this morning. The price action was not surprising as we indicated last Friday (12 Aug, spot at 0.6365) that our long-held level of 0.6350 is “within sight”. While further NZD weakness is not ruled, the current decline is over-extended and the next support at 0.6300 could be out of reach. That said, NZD is not out of the woods yet as it has to reclaim 0.6430 (‘key resistance’ was at 0.6455 last Friday) in order to indicate that a short-term bottom is in place”.

British banks last month approved the most mortgages since February 2017, adding to signs that the housing market has picked up from its recent pre-Brexit slowdown, a survey showed on Tuesday.

Banks approved 43,342 mortgages in July, up from 42,775 in March and 10.6% higher than a year earlier, according to seasonally-adjusted figures from industry body UK Finance.

Net mortgage lending rose by 2.947 billion pounds last month, the biggest increase since March 2016 and up from an increase of 1.764 billion pounds in June.

UK Finance said consumer lending rose 4.3% year-on-year in July, the strongest increase since February 2018.

Lending figures from the Bank of England, which cover a broader section of Britain's finance industry, are due on Friday.

FX Strategists at UOB Group see EUR/USD keeping the 1.1080/1.1140 range in the very near term.

24-hour view: “Despite overall positive indications, EUR was not able to build on its gains as it dropped rapidly to an overnight low of 1.1092. While there is room for the decline in EUR to extend lower, downward momentum is not strong and any weakness is viewed as a lower trading range of 1.1080/1.1140 (a sustained down-move is not expected)”.

Next 1-3 weeks: “There is not much to add to the update from yesterday (26 Aug, spot at 1.1145). As highlighted, the current movement in EUR is viewed as a corrective rebound that has room to extend higher. However, the month-to-date high near 1.1250 is a solid resistance and this level could be out of reach. After yesterday’s rapid retreat, 1.1180 is already quite a strong level ahead of 1.1220 and 1.1250. On the downside, a break of 1.1050 would indicate that the current upward pressure has eased”.

Profits at China’s industrial firms returned to growth in July, helped by public works spending and improved margins in the petrochemical and auto sectors, but an economic slowdown and the U.S. trade war are expected to weigh on the business outlook.

Industrial profits rose 2.6% in July year-on-year to 512.7 billion yuan ($72.28 billion), according to data released by the National Bureau of Statistics (NBS), swinging from a 3.1% decline in June.

Despite the turnaround in headline growth, worsening conditions for businesses exposed to global trade and smaller private sector firms are likely to add to case for more government support to shore up slowing economic growth.

“The downward pressure on the economy is relatively high, the market demand is slowing down, the prices of industrial products are falling,” the statistics bureau’s senior statistician, Zhu Hong, said in a statement accompanying the data.

“There will still likely be volatility and uncertainty in profits of industrial enterprises,” Zhu said.

For January-July, industrial firms earned profits of 3.50 trillion yuan, down 1.7% from a year earlier. That compared with a 2.4% fall in the first six months.

Danske Research flags a scope of pricing more market's uncertainty ahead of the key US data releases (ISM and NFP) next week.

"USD rates and USD/JPY are now trading close to mid-August lows and even EUR/USD bounced on the news even though the pair has been less receptive to trade and/or US monetary policy news lately," Danske notes.

"Development on Friday means that markets will be on its toes this week before key US data releases (ISM and NFP) next week. We stress that we still see potential for USD/JPY to undershoot our 3M forecast of 105," Danske adds.

Trade negotiations between the United States and Europe will be difficult but the global economic downturn increases the chances for the parties to reach a deal, German Economy Minister Peter Altmaier said on Tuesday.

"The talks which lie ahead will be difficult," Altmaier told public broadcaster Deutschlandfunk.

"I was there (in the U.S.) in June and my impression is that, for the U.S. administration, reaching a solution is seen as more important than continuing the conflict," he added.

Economists at UOB Group assessed the recent escalation in the US-China trade tensions as well as a potential reaction by the Federal Reserve.

“With US-China trade tensions escalating further, we have now entered the Worst Case Scenario of our earlier assessment. Furthermore, the situation could worsen further from here. We now see our base case scenario that US and China imposition of additional tariffs on nearly all bilateral merchandise trade flows will materialise and stay at least in the near-term and there is potential for further retaliations which may involve restrictions on technology transfer and other non-trade measures. Any trade deal, if it happens, may only be in 1H2020 at the earliest. In our New Worst Case Scenario (at 35% probability), services trade and other areas including investment restrictions and rare earth export could become targets while the tariff rate on the entire merchandise trade between the two countries may be increased further. The escalation in US-China trade tensions will probably cause our 2019 growth forecast of 6.2% to drop by 0.1% point if the announced additional tariffs are implemented as scheduled. With 1H19 growth at 6.3% y/y, this would mean that 2H19 growth could be just bordering at 6.0% y/y”.

According to the report from insee, in August 2019, households’ confidence in the economic situation has been stable. At 102, the synthetic index remains slightly above its long-term average (100).

In August, households' opinion balance on their past personal financial situation has increased slightly. It has gained 2 points and remains above its long-term average. In addition, households' opinion balance about their future financial situation has been stable and remains slightly above its long-term average.

The share of households considering it is a suitable time to make major purchases is unchanged compared to last month and remains above its long-term average.

In August, the share of households considering it is a suitable time to save has increased: the corresponding balance has gained 3 points but remains below its long-term average.

Households' opinion on their current and expected saving capacities has been virtually stable. The corresponding balances both remain well above their long-term average.

Households' fears about the unemployment trend have declined again in August: the corresponding balance has fell by 4 points after having lost 2 points in July. It thus reaches its lowest level since October 2018 and remains well below its long-term average.

In August, households considering that prices will be on the rise during the next twelve months have been slightly more numerous than the previous month: the corresponding balance has gained 2 points and remains well above its long-term average. However, the share of households considering that prices were on the rise during the past twelve months has been virtually stable: the corresponding balance has lost 1 point and remains clearly below its long-term average.

Karen Jones, analyst at Commerzbank, suggests that for the EUR/USD pair, despite the rally on Friday the market did not do enough to negate downside pressure.

“Intraday Elliott wave counts remain neutral to negative. Beyond this attention remains still on the 1.1027 recent low and the base of its down channel at 1.0948. Below here lies the 78.6% retracement at 1.0814/78.6% retracement. Nearby resistance is the 200 day ma at 1.1281, but key resistance is 1.1339/58, the 2018-2019 down channel and the 55 week ma. A weekly close above this latter level is needed for us to adopt an outright bullish stance. The market will need to regain the 55 week ma and channel at 1.1339/58 to generate upside interest.”

According to the report from Federal Statistical Office (Destatis), in the second quarter of 2019, the real (price-adjusted) gross domestic product (GDP) was down 0.1% from the preceding quarter, after adjustment for seasonal and calendar variations. In the first quarter of 2019, the German economy had grown by 0.4%.

The development of foreign trade slowed down economic growth in the second quarter of 2019. After seasonal and calendar adjustment,price-adjusted exports were down 1.3% from the preceding quarter, markedly more than imports (-0.3%).

The quarter-on-quarter comparison (price-adjusted and adjusted for seasonal and calendar variations) shows that positive contributions came from domestic demand, according to provisional calculations. Household final consumption expenditure increased by 0.1% from the first quarter of 2019 and government final consumption expenditure rose by 0.5%. Capital formation was up, too. Fixed capital formation in machinery and equipment increased by 0.6% and in other fixed assets by 1.0% on the preceding quarter. Only gross fixed capital formation in construction went down in the second quarter (-1.0%), probably also because of the mild weather at the beginning of the year, which led to high growth rates for fixed capital formation in construction in the first quarter (+2.5%).

Real GDP stagnated year on year. After calendar adjustment, GDP was up by 0.4% because the second quarter of 2019 had one working day less than the same quarter a year earlier. In the first quarter of 2019, real GDP was 0.8% (calendar-adjusted: 0.9%) higher than in the same quarter of the preceding year.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1213 (2399)

$1.1176 (2451)

$1.1148 (906)

Price at time of writing this review: $1.1100

Support levels (open interest**, contracts):

$1.1067 (4571)

$1.1034 (3844)

$1.0992 (7350)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 6 is 109364 contracts (according to data from August, 26) with the maximum number of contracts with strike price $1,1400 (8842);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2349 (2236)

$1.2293 (1127)

$1.2260 (772)

Price at time of writing this review: $1.2219

Support levels (open interest**, contracts):

$1.2161 (1533)

$1.2136 (1035)

$1.2069 (1965)

Comments:

- Overall open interest on the CALL options with the expiration date September, 6 is 30598 contracts, with the maximum number of contracts with strike price $1,2750 (4128);

- Overall open interest on the PUT options with the expiration date September, 6 is 25601 contracts, with the maximum number of contracts with strike price $1,2100 (1965);

- The ratio of PUT/CALL was 0.84 versus 0.83 from the previous trading day according to data from August, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 58.21 | -0.33 |

| WTI | 53.67 | 0.07 |

| Silver | 17.64 | 1.09 |

| Gold | 1527.316 | -0.28 |

| Palladium | 1477.77 | 1.49 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -449.87 | 20261.04 | -2.17 |

| Hang Seng | -499 | 25680.33 | -1.91 |

| KOSPI | -31.99 | 1916.31 | -1.64 |

| ASX 200 | -83 | 6440.1 | -1.27 |

| DAX | 46.53 | 11658.04 | 0.4 |

| Dow Jones | 269.93 | 25898.83 | 1.05 |

| S&P 500 | 31.27 | 2878.38 | 1.1 |

| NASDAQ Composite | 101.97 | 7853.74 | 1.32 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67739 | 0.44 |

| EURJPY | 117.788 | 0.44 |

| EURUSD | 1.10992 | -0.36 |

| GBPJPY | 129.673 | 0.31 |

| GBPUSD | 1.22194 | -0.51 |

| NZDUSD | 0.63916 | 0.01 |

| USDCAD | 1.32523 | -0.25 |

| USDCHF | 0.97891 | 0.48 |

| USDJPY | 106.116 | 0.84 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.