- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-09-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | House Price Index (QoQ) | Quarter II | -3% | -1% |

| 01:30 | Australia | RBA Meeting's Minutes | |||

| 05:45 | Switzerland | SECO Economic Forecasts | |||

| 09:00 | Eurozone | ZEW Economic Sentiment | September | -43.6 | |

| 09:00 | Germany | ZEW Survey - Economic Sentiment | September | -44.1 | -38 |

| 12:30 | Canada | Manufacturing Shipments (MoM) | July | -1.2% | -0.3% |

| 13:15 | U.S. | Capacity Utilization | August | 77.5% | 77.6% |

| 13:15 | U.S. | Industrial Production (MoM) | August | -0.2% | 0.2% |

| 13:15 | U.S. | Industrial Production YoY | August | 0.5% | |

| 14:00 | U.S. | NAHB Housing Market Index | September | 66 | 66 |

| 17:10 | Eurozone | ECB's Benoit Coeure Speaks | |||

| 20:00 | U.S. | Total Net TIC Flows | July | 1.7 | |

| 20:00 | U.S. | Net Long-term TIC Flows | July | 99.1 | |

| 22:45 | New Zealand | Current Account | Quarter II | 0.68 | -1.117 |

| 23:50 | Japan | Trade Balance Total, bln | August | -249.6 | -355.9 |

Major US stock indices fell moderately amid fears that a sharp increase in oil prices after an attack on oil facilities in Saudi Arabia could slow the growth of the global economy.

West Texas Intermediate (WTI) oil futures jumped nearly 13% and are trading at $ 61.80 a barrel. The sharp increase occurred after a series of UAV attacks on oil facilities by the Saudi company Saudi Aramco on Saturday, as a result of which oil production in the country fell by 5.7 million barrels. This represents about 50% of daily oil production in Saudi Arabia and about 5% of world production.

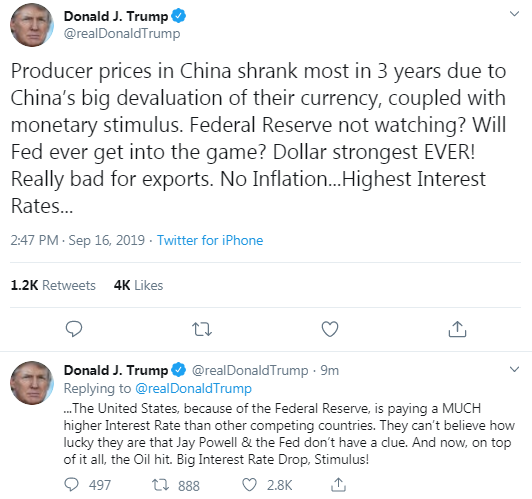

US President Trump wrote on Twitter on Sunday that, to stabilize the oil market, he “authorized the release of oil from the strategic oil reserve, if necessary, in an amount sufficient to keep the markets well-stocked.”

Hussite Yemeni rebels claimed responsibility for the strike on Saudi targets, but US Secretary of State Pompeo said Iran was behind the attack.

Initially, the media reported that Saudi Aramco plans to recover about half of the lost production before the end of Monday. However, Bloomberg reported today that the company is already less optimistic in its estimates.

Higher oil prices are expected to lead to higher fuel prices. This will put additional pressure on the global economy, which has already faced a slowdown in growth in the manufacturing sector. However, the jump in oil prices pushed up the shares of energy companies.

Market participants are also awaiting the Fed’s decision on monetary policy on Wednesday. According to forecasts, the US Central Bank announces a second interest rate cut this year by a quarter basis point. Investors will carefully scrutinize the regulator’s statements for hints as to whether it will continue to soften its monetary policy, which is expected to be crucial in determining the future movement of Wall Street.

Most of the DOW components completed trading in the red (25 of 30). The Walt Disney Company (DIS; -1.79%) turned out to be an outsider. The biggest gainers were Chevron Corp. (CVX; + 2.36%).

Almost all S&P sectors recorded a decline. The largest decline was shown by the services sector (-1.0%). The raw materials sector grew the most (+ 2.2%).

At the time of closing:

Dow 27,076.82 -142.70 -0.52%

S&P 500 2,997.96 -9.43 -0.31%

Nasdaq 100 8,153.54 -23.17 -0.28%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | House Price Index (QoQ) | Quarter II | -3% | -1% |

| 01:30 | Australia | RBA Meeting's Minutes | |||

| 05:45 | Switzerland | SECO Economic Forecasts | |||

| 09:00 | Eurozone | ZEW Economic Sentiment | September | -43.6 | |

| 09:00 | Germany | ZEW Survey - Economic Sentiment | September | -44.1 | -38 |

| 12:30 | Canada | Manufacturing Shipments (MoM) | July | -1.2% | -0.3% |

| 13:15 | U.S. | Capacity Utilization | August | 77.5% | 77.6% |

| 13:15 | U.S. | Industrial Production (MoM) | August | -0.2% | 0.2% |

| 13:15 | U.S. | Industrial Production YoY | August | 0.5% | |

| 14:00 | U.S. | NAHB Housing Market Index | September | 66 | 66 |

| 17:10 | Eurozone | ECB's Benoit Coeure Speaks | |||

| 20:00 | U.S. | Total Net TIC Flows | July | 1.7 | |

| 20:00 | U.S. | Net Long-term TIC Flows | July | 99.1 | |

| 22:45 | New Zealand | Current Account | Quarter II | 0.68 | -1.117 |

| 23:50 | Japan | Trade Balance Total, bln | August | -249.6 | -355.9 |

- If we cannot do a deal, we will come out on Oct 31

- The Irish border backstop needs to go from the treaty

- A deal will require movement but there is a good shape of a deal

- We have agreed to accelerate the work today

- We are working hard for a deal

Analysts at Deutsche Bank note that the overwhelming consensus (and DB) expectation is for another 25bp rate cut from the U.S. Fed this week, following the 25bp cut at the July meeting, which was the first rate-cut since 2008.

- “The main focus will be on where they go after this week. Our economists think a continued dovish bias should be evident in the statement language, Summary of Economic Projections and Chair Powell’s press conference. It seems Powell is still keen to emphasize the baseline as a mid-cycle slowdown though over anything more sinister but it’s hard to imagine him not highlighting the risks, especially around trade.

- Expect the “act as appropriate to sustain the expansion” line to continue to be the takeaway. A reminder that after this 25bps cut our economists expect a further cumulative 75bps of rate cuts (Oct, Dec, Jan) after next week’s reduction.

- With all the positive data releases from the US last week, which also included lower-than-expected weekly jobless claims and higher-than-expected consumer borrowing figures, investors reassessed the chances of aggressive easing from the Federal Reserve over the coming months. By the end of last week, investors saw the chances of at least 75bps of further cuts from the Fed this year at 17.6%, down from 40.6% at the end of the previous week. Meanwhile, the chances of just one further 25bp cut this year rose over the last week from 13.7% to 33.3%.”

Analysts at Standard Chartered note that China’s growth slowed across the board in August, failing market expectations of recovery after a disappointing July.

- “Industrial production (IP) growth decelerated further to 4.4% y/y in August, averaging only 4.6% in the first two months of Q3, down from 5.6% in Q2.

- Fixed asset investment (FAI) growth slowed to 3.3% y/y in real terms in August, from 3.9% in July and 3.8% in Q2, due to falling manufacturing investment (down 1.6% y/y in August in nominal terms versus 4.7% growth in July).

- PPI deflation deepened to 0.8% y/y in August. Falling PPI has seen industrial profits decline 1.7% y/y from January-July, compared to a 17% increase during the same period last year.

- We expect China’s GDP growth to moderate to 6.1% y/y in Q3, from 6.4% in Q1 and 6.2% in Q2.

- We maintain our forecast that the People’s Bank of China (PBoC) will cut the required reserve ratio (RRR) by another 50bps or inject liquidity via the medium-term lending facility (MLF) before end-2019. We also expect the PBoC to cut the MLF rate twice by 10bps each in the rest of 2019, with the first cut as early as September and again in Q4.”

- Told EU's Juncker that UK was leaving on October 31

- Says UK and EU leaders agreed that Brexit discussions must intensify

- Agreed that talks should also take place at a political level between Barnier and the Brexit secretary

- Also agreed conversations would continue between Johnson and Juncker

U.S. stock-index futures fell on Monday amid worries that a climb in oil prices following the weekend attack on Saudi Arabian oil facilities could slow down global economic growth.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | - | - | - |

Hang Seng | 27,124.55 | -228.14 | -0.83% |

Shanghai | 3,030.75 | -0.48 | -0.02% |

S&P/ASX | 6,673.50 | +4.30 | +0.06% |

FTSE | 7,350.43 | -17.03 | -0.23% |

CAC | 5,622.08 | -33.38 | -0.59% |

DAX | 12,403.29 | -65.24 | -0.52% |

Crude oil | $60.47 | +10.25% | |

Gold | $1,510.00 | +0.70% |

Analysts at Danske Bank note that China's data disappointed overnight as industrial production growth dropped to a new low at 4.4% y/y (consensus 5.2% y/y, previous 4.8% y/y).

- “Retail sales were also lower than expected at 7.5% y/y (consensus 7.9% y/y, previous 7.6% y/y). It underlines that the world's biggest growth engine continues to see downward pressure on growth.

- China's premier Li Keqiang said in an interview that it is 'very difficult' for China's economy to grow at 6% or more. We expect more stimulus to be announced from China in coming months.”

According to CFTC’s Commitment of Traders Report, USD net longs crept higher to their strongest levels since March, Rabobank's analysts note.

- "Even though markets are looking ahead to further Fed easing this week the USD can also be sensitive to the overall level of risk appetite and outflows from emerging markets.

- Net EUR short positions edged even higher last week ahead of the September ECB meeting.

- Net short GBP positions have surged, though they remain below their August high.

- JPY net positions have been back in positive ground for six straight weeks on safe-haven demand.

- CHF net shorts eased a little last week on increased demand for safe-haven assets.

- CAD net long positions surged as the BoC remained defiant at its Sep 4 policy meeting.

- AUD net shorts edged slightly lower for a fourth week.”

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 22.75 | -0.14(-0.61%) | 2856 |

ALTRIA GROUP INC. | MO | 41.75 | -0.26(-0.62%) | 37889 |

Amazon.com Inc., NASDAQ | AMZN | 1,826.00 | -13.34(-0.73%) | 17825 |

AMERICAN INTERNATIONAL GROUP | AIG | 56.65 | -0.32(-0.56%) | 320 |

Apple Inc. | AAPL | 217.87 | -0.88(-0.40%) | 218386 |

AT&T Inc | T | 37.58 | -0.33(-0.87%) | 57511 |

Boeing Co | BA | 376.7 | -3.06(-0.81%) | 9160 |

Caterpillar Inc | CAT | 133.25 | -0.53(-0.40%) | 5859 |

Chevron Corp | CVX | 125.5 | 4.00(3.29%) | 55236 |

Cisco Systems Inc | CSCO | 49.83 | -0.20(-0.40%) | 17249 |

Citigroup Inc., NYSE | C | 68.83 | -1.56(-2.22%) | 50319 |

E. I. du Pont de Nemours and Co | DD | 73.5 | -0.04(-0.05%) | 517 |

Exxon Mobil Corp | XOM | 75.49 | 2.85(3.92%) | 274398 |

Facebook, Inc. | FB | 186 | -1.19(-0.64%) | 24067 |

FedEx Corporation, NYSE | FDX | 172.09 | -2.01(-1.15%) | 2548 |

Ford Motor Co. | F | 9.39 | -0.06(-0.63%) | 12791 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.73 | -0.03(-0.28%) | 66326 |

General Motors Company, NYSE | GM | 37.91 | -0.95(-2.44%) | 136915 |

Goldman Sachs | GS | 217.75 | -2.15(-0.98%) | 5643 |

Google Inc. | GOOG | 1,231.39 | -8.17(-0.66%) | 1839 |

Hewlett-Packard Co. | HPQ | 18.8 | -0.28(-1.47%) | 6065 |

Home Depot Inc | HD | 233.05 | -0.93(-0.40%) | 2258 |

HONEYWELL INTERNATIONAL INC. | HON | 167.25 | -0.46(-0.27%) | 229 |

Intel Corp | INTC | 52.08 | -0.46(-0.88%) | 10653 |

International Business Machines Co... | IBM | 142.52 | -1.15(-0.80%) | 671 |

Johnson & Johnson | JNJ | 130.3 | -0.48(-0.37%) | 1497 |

JPMorgan Chase and Co | JPM | 118.6 | -1.63(-1.36%) | 32083 |

McDonald's Corp | MCD | 209.52 | -0.29(-0.14%) | 1470 |

Merck & Co Inc | MRK | 82.35 | -0.26(-0.31%) | 1513 |

Microsoft Corp | MSFT | 136.5 | -0.82(-0.60%) | 40430 |

Nike | NKE | 86.9 | -0.42(-0.48%) | 2182 |

Pfizer Inc | PFE | 36.76 | -0.15(-0.41%) | 1568 |

Procter & Gamble Co | PG | 121.9 | -0.22(-0.18%) | 987 |

Starbucks Corporation, NASDAQ | SBUX | 90.2 | -0.28(-0.31%) | 2456 |

Tesla Motors, Inc., NASDAQ | TSLA | 247.45 | 2.25(0.92%) | 66043 |

The Coca-Cola Co | KO | 54.2 | -0.06(-0.11%) | 1848 |

Twitter, Inc., NYSE | TWTR | 42.45 | -0.18(-0.42%) | 7908 |

United Technologies Corp | UTX | 138 | -0.06(-0.04%) | 3097 |

UnitedHealth Group Inc | UNH | 231.5 | -2.11(-0.90%) | 1126 |

Verizon Communications Inc | VZ | 59.72 | -0.24(-0.40%) | 1223 |

Visa | V | 175.78 | -1.49(-0.84%) | 15897 |

Wal-Mart Stores Inc | WMT | 117.17 | -0.26(-0.22%) | 4199 |

Walt Disney Co | DIS | 137.2 | -0.82(-0.59%) | 8709 |

Yandex N.V., NASDAQ | YNDX | 38.12 | 0.24(0.63%) | 7833 |

JPMorgan Chase (JPM) downgraded to Neutral from Buy at Buckingham Research; target $122

Lyft (LYFT) upgraded to Buy from Hold at HSBC Securities; target lowered to $62

Uber (UBER) upgraded to Buy from Hold at HSBC Securities; target lowered to $44

The report from

the New York Federal Reserve showed on Monday that manufacturing activity in

the New York region worsened modestly in September.

According to

the survey, NY Fed Empire State manufacturing index came in at 2.0 this month

compared to an unrevised 4.8 in August, pointing to two months of modest growth

after a brief decline in activity in June.

Economists had

expected the index to drop to 4.0.

Anything below

zero signals contraction.

According to

the report, the new orders index declined three points to 3.5, pointing to a small

increase in orders, while the shipments index declined four points to 5.8, its

lowest level in nearly three years. Meanwhile, unfilled orders remained

negative for a fourth consecutive month, and inventories increased for a second

straight month. The index for number of employees rose to 9.7, pointing to an advance in employment levels after three months of

declines. On the price front, the prices paid index grew six points to 29.4,

and the prices received index surged five points to 9.2.

- ECB mandate for price stability is unconditional

- Incoming information signals more extended slowdown in Eurozone growth dynamics

- This slowdown is mainly due to external developments

- The case for monetary policy response was clear

- ECB policies create a cushion to insulate the economy from the materialization of downside risks

Analysts at TD Securities note that Canada’s existing-home sales for August are set to be published at 9AM with the market looking for an increase of 1.5% m/m.

- “If realized, this would represent the sixth consecutive pickup in monthly sales activity and bolster expectations for further gains in residential investment for Q3, complementing recent strength in housing starts. International securities transactions for July will round out the data calendar.”

- We are seeking a deal and will take right steps to achieve that

Analysts at TD Securities are expecting the New York Empire State Manufacturing Index to have pared back modestly to 4.0 in September from 4.8 before.

- “Although the index has shown some consolidation after the massive June drop, it remains at odds with the performance of the more widely-tracked ISM manufacturing index, which has continued to underperform in recent months.”

Iris Pang, the economist for Greater China at ING, notes that China's fixed-asset investments and industrial production were very weak in August while retail sales growth was moderate.

- "Frankly speaking, August's industrial production and fixed asset investment data was a wake-up call. Even with a large fiscal stimulus in infrastructure investment, it will be hard to overcome the damage from the loss of export orders due to the trade war and the structural weakness in global demand for smartphones and related products, both of which are highly weighted in the industrial production data.

- The number of smartphones produced fell 10.7% year-on-year, which led to an overall drop of 6.2% YoY in electronic telecom devices. The production of cars fell 7.3% YoY. These products not only face headwinds from structural changes in their own markets but also from soft global demand.

- From fixed asset investments, we see that railway investment and mining supported most of the growth. Railway investment grew 11.0% YoY YTD while mining grew 26.2% YoY YTD.

- However, again, these investments cannot help sectors that are directly hit by the trade war. Textile investment fell 5.0% YoY YTD.

- Retail sales grew 7.2% YoY. We believe that this was supported by the stable job market. The surveyed jobless rate edged down from 5.3% to 5.2%.

- Apart from automobiles, all items reported positive year-on-year growth. One reason for this is that food prices have been high due to swine flu.

- We believe that some consumers will spend money at home, rather than take overseas trips, which will be supportive to domestic retail sales.

- ...Due to the expected further damages from the trade and technology wars, we are revising our 2019 GDP growth forecast to 6.0%, and to 5.7% YoY and 5.8% YoY for 3Q19 and 4Q19, respectively. Our previous forecasts were 6.3% for 2019 and 6.1% YoY and 6.3% YoY in 3Q19 and 4Q19."

- Europe never loses patience

- Says that Iran attacked Saudi Arabia

- Adds that attack on Saudi Arabia was an attack on the world energy system

Analysts at Rabobank offered their take on the upcoming Bank of England (BoE) meeting and expect the central bank to leave the policy rate unchanged at 0.75% on Thursday 19 September.

“This is also the consensus view and GBP OIS implies virtually no chance of a move in either direction at this week’s meeting. Whilst the OIS market is –on balance– still looking for a rate cut in early-2020, the implied probabilities closely track those of a no-deal Brexit. As such, the passage of a law that requires the Prime Minister to ask EU leaders for another 3-month delay if no deal has been reached has lowered the odds of a rate cut in the near term. There will be no inflation report or news conference, but the minutes could potentially provide some indications about the MPC’s latest thinking on Brexit. While we stick to our forecast for no changes in Bank rate in 2019 and 2020 on the premise that the UK will eventually leave the European Union with a deal in place, the risk of a no-deal Brexit remains a sword of Damocles hanging over the UK economy.”

Reuters quotes German diplomatic sources as saying that Germany wants to limit the bloc’s next budget for 2021-27 at 1% of the bloc’s economic output, below the 1.11% proposed by the executive European Commission.

Sources added that the biggest net contributor to the bloc’s joint coffers - would present the proposal to fellow ministers on Monday.

World trade in commercial services lost momentum in the second quarter of 2019, indicating it "continued to face strong headwinds", but has generally fared better than trade in goods, which have been more directly hit by rising tensions, the WTO said on Monday.

Passenger air travel, construction and the global services purchasing managers' index fell further below trend in June, while the financial services index was "slightly below trend", and ICT services dipped to be on trend, the World Trade Organization said in its new monthly services trade barometer.

In light of the recent performance, EUR/GBP is now expected to stabilize in the 0.8940 region, noted Axel Rudolph, Senior FICC Technical Analyst at Commerzbank.

“EUR/GBP slid through the July and previous September lows at .8891/85 and is about to reach the 20 day moving average at .8841 around which it is expected to short-term stabilise. We thus turned medium-term bearish. The 61.8% Fibonacci retracement of the May-to-August advance at .8794 is next in line. Minor resistance above the .8891 July low and the .9016 September 9 high can be seen between the mid-July high and the 55 day moving average at .9052/54. Further resistance comes in at the .9149 current September high. Still further up sits the August peak at .9327”.

Europe's fiscal framework needs urgent improvement and the bloc should work towards union on it, European Central Bank policymaker Pablo Hernandez De Cos said on Monday.

"I strongly believe that a central fiscal capacity at euro area level could contribute (...) to macroeconomic stabilisation," De Cos said.

"In this respect, monetary policy would not become overburdened, as it might be in the current economic juncture," he added.

Facing a protracted growth slowdown, the European Central Bank cut rates deeper into negative territory on Thursday and relaunched fresh bond purchases with no scheduled end-date, a move that divided the normally collegial Governing Council.

Analysts at Australia and New Zealand (ANZ) Group offer a sneak peek at what to expect from Thursday’s Bank of Japan (BOJ) monetary policy meeting.

“The Bank of Japan (BOJ) is under pressure to ease policy. With its global peers easing, achieving its inflation goal is likely to become even more elusive. Governor Kuroda recently said that momentum toward its price stability target is being maintained, suggesting he isn’t on board yet for an easing. At some point, it will need to deliver. The BOJ is likely mulling over a number of easing options, including a further cut to the negative policy rate and possibly a reverse-twist operation to help steepen the yield curve.”

The United States will agree not to raise tariffs or introduce curbs to import quotas on Japanese cars when the country's leaders meet next week, the Tokyo Shimbun newspaper reported on Monday.

The newspaper said the pledge would be part of a joint leaders' statement on trade that is due to be released following a meeting between U.S. President Donald Trump and Japanese Prime Minister Shinzo Abe next week in New York.

Washington and Tokyo agreed to the core elements of a trade deal last month on the sidelines of a Group of Seven Summit, with Trump and Abe saying they hoped to sign an agreement this month.

As part of the limited trade deal, Tokyo would make concessions on agricultural imports from the United States while Washington would refrain from raising tariffs on Japanese cars as Trump had threatened to do earlier.

Britain's exit from the European Union without a divorce agreement would be a disaster and must be ruled out, Europe's biggest business organisation said on Monday, as EU officials warn this worst-case scenario is increasingly likely.

After twice postponing the date of leaving the EU, Britain is now set to exit on Oct. 31, but the country's parliament and public are deeply divided over the terms of the divorce.

"No deal is a recipe for disaster and should be definitely ruled out. A disorderly, no deal exit of the UK would be extremely harmful for all sides. It would cause massive damage for citizens and businesses in the UK and on the continent alike," BusinessEurope Director General Markus Beyrer said.

"The negative consequences would not be limited to the exit date but would drag on, endangering the fruitful and positive future relationship we all aim for," Beyrer said.

Researchers at UOB Group now see the Federal Reserve reducing the upper end of the FFTR to 1.5% by year-end.

“The intensification of the US-China tariff fight in 3Q took us by surprise and the worsening trade policy development will likely “push” the Fed to take on more “insurance” rate cuts in 2019. We now expect the Fed to cut the FFTR by another 25bps in the 17/18 Sep 2019 FOMC. We also project two more 25bps “insurance” rate cuts in the 29/30 Oct and the 10/11 Dec FOMC, bringing the upper bound of the FFTR lower to 1.5%, well below the 2% inflation target. We have not priced in further cuts in 2020 and our base case is for some sort of US-China trade deal happening in 1H 2020. However, if trade tensions persist well beyond 2019, then we think the Fed will have to take on more “insurance” easing, especially if it leads to material downside impact to US and global growth”.

Ron Paul is warning negative interest rates will crush the global economy. The former Republican congressman from Texas believes the U.S. won’t be the exception.

“We will join the rest of them and go to total negative rates in hopes that that will be the solution,” he told CNBC. “We’ve never had as many currencies in negative interest rates. $17 trillion worth of bonds [are] in negative interest rates. It’s never existed before. And, that’s a bubble. So, we’re in the biggest bond bubble in history, and it’s going to burst.”

Paul contends the Federal Reserve’s policies are powerless in this environment. He doesn’t believe this week’s Fed meeting will provide any kind of relief and cutting rates will not be the answer. “You can’t predict exactly where the creation of credit goes,” said Paul. “We have a ton of inflation with all that QE [quantitative easing]. And, every time you lower interest rates below market levels and create new credit, that’s a bubble.”

Paul has been waving the red flag for years, warning that a once in a lifetime market drop of 50% or more will strike stocks. With bonds yielding negative rates now in focus, he suggests the danger is ballooning to unseen levels.

Amid lack of first-tier macroeconomic releases, the TD Securities analysts offer a list of key events that will provide some impetus in the day ahead.

“EUR The ECB's Chief Economist Philip Lane speaks in London at 12.00 GMT on the economic outlook and monetary policy for the Eurozone. There will also be a Q&A, which will give Lane ample opportunity to delve into the economic impact of the ECB's policy announcement, and give us a better idea of how much and what kind of further easing we may see at some point in the future.

CAD Existing home sales for August will be published at 12.30 GMT with the market looking for an increase of 1.5% m/m. If realized, this would represent the sixth consecutive pickup in monthly sales activity and bolster expectations for further gains in residential investment for Q3, complementing recent strength in housing starts. International securities transactions for July will round out the data calendar.

USD The Empire Manufacturing Index is expected to have pared back modestly to 4.0 in September from 4.8 before. Although the index has shown some consolidation after the massive June drop, it remains at odds with the performance of the more widely-tracked ISM manufacturing index, which has continued to underperform in recent months.”

The attacks on critical oil production facilities in Saudi Arabia over the weekend will effectively wipe out the world’s spare oil capacity, an expert from S&P Global Platts said.

Drone strikes attacked a oil processing facility at Abqaiq and the nearby Khurais oil field on Saturday, knocking out 5.7 million barrels of daily crude production — or 50% of the kingdom’s oil output. That’s more than 5% of global daily oil production.

“This heightens the risk premium, it puts a lot of pressure on the supply side,” said Sarah Cottle, global head of market insight at S&P Global Platts.

“This incident effectively eliminates the world’s spare capacity,” Cottle told CNBC, though she added the longer-term outlook is bullish due to the immediate need to draw down on crude stockpiles.

Chinese Premier Li Keqiang said it is “very difficult” for China’s economy to grow at a rate of 6% or more because of the high base from which it was starting and the complicated international backdrop.

The world’s No.2 economy faced “certain downward pressure” due to slowing global growth as well as the rise of protectionism and unilateralism, Li said in.

China’s gross domestic product (GDP) grew 6.3% in the first half of the year, and Li said the economy was “generally stable” in the first eight months of the year.

“For China to maintain growth of 6% or more is very difficult against the current backdrop of a complicated international situation and a relatively high base, and this rate is at the forefront of the world’s leading economies,” Li was quoted as saying.

Analysts say China’s economic growth has likely cooled further this quarter from a near 30-year low of 6.2% in April-June.

Zhaopeng Xing and Raymond Yeung, Analysts at Australia and New Zealand (ANZ) Group offer a quick reaction to the disappointing China macro data released earlier today.

“Today’s weak data print falls short of expectations, and signals that China’s domestic consumption is not yet ready to be the key economic growth engine, as the growth in real retail sales (deducted price factors) fell to 5.6% y/y in August, lower than the real GDP target. China’s FAI also retreated to 5.5% in August, pointing to underlying weakness in the manufacturing sector even as infrastructural investment growth quickened 0.4% to 4.2% for the January to August period. The prospects of an industrial recession pose significant downside risks to China’s GDP growth in Q3, prompting further expectations of more monetary and fiscal policy measures ahead.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1204 (2137)

$1.1181 (1844)

$1.1156 (1437)

Price at time of writing this review: $1.1070

Support levels (open interest**, contracts):

$1.1025 (13307)

$1.0985 (4454)

$1.0941 (3199)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 4 is 93057 contracts (according to data from September, 13) with the maximum number of contracts with strike price $1,1050 (13307);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2637 (1436)

$1.2612 (1794)

$1.2591 (703)

Price at time of writing this review: $1.2465

Support levels (open interest**, contracts):

$1.2346 (563)

$1.2310 (695)

$1.2270 (387)

Comments:

- Overall open interest on the CALL options with the expiration date October, 4 is 15070 contracts, with the maximum number of contracts with strike price $1,2500 (1794);

- Overall open interest on the PUT options with the expiration date October, 4 is 14394 contracts, with the maximum number of contracts with strike price $1,1900 (1465);

- The ratio of PUT/CALL was 0.96 versus 0.97 from the previous trading day according to data from September, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 59.48 | -0.45 |

| WTI | 54.74 | -0.49 |

| Silver | 17.4 | -3.71 |

| Gold | 1488.516 | -0.69 |

| Palladium | 1607.84 | -0.56 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68767 | 0.17 |

| EURJPY | 119.7 | 0.1 |

| EURUSD | 1.10722 | 0.1 |

| GBPJPY | 135.08 | 1.32 |

| GBPUSD | 1.24966 | 1.3 |

| NZDUSD | 0.63757 | -0.46 |

| USDCAD | 1.3285 | 0.6 |

| USDCHF | 0.9901 | -0.01 |

| USDJPY | 108.069 | 0 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.